Support

Puoi contribuire al Museo M I C R O in molti modi

DONATES AN OLD DEVICE

The material in the (for now virtual) museum is kindly donated by Members and sympathizers of our Association. A great deal of work, many computers, consoles, peripherals and an innumerable amount of spare parts are needed to make our exhibit ever richer and more interesting, and especially with many working computers.

Since 8 Bit Inside is a nonprofit association, it can also receive materials from public agencies, which often hold large quantities of items destined for scrap and which instead have great historical significance.

8 Bit Inside gladly accepts pieces that are still missing from the museum's collection, accessories and peripherals, duplicate pieces that can be used to keep the exhibit active and alive, and in rare cases (due to space constraints) even non-working machines, if they are of historical importance and aesthetically in good condition, or to salvage spare parts. Apparatus of interest to the Association range from retrocomputing, to retrogaming, to retromusic.

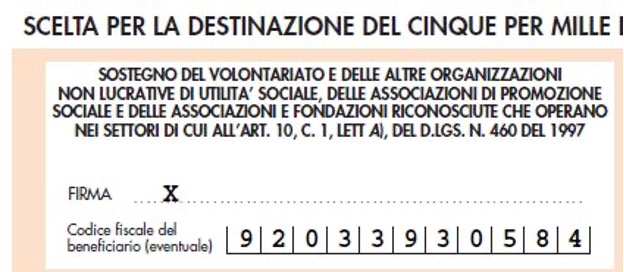

5x1000

8 Bit Inside ONLUS is on the list of non-profit associations eligible for the 5 per thousand of Irpef, a signature that costs you nothing but means a lot to us.

A very simple gesture to give us a concrete hand, wherever you are, to maintain the existing collection and grow the Association all together.

Many thanks from all the Staff of 8 Bit Inside!

BECOME A MEMBER

Becoming a Member of the 8 Bit Inside association is the most direct way to participate in our activities. Members will participate in the live and online Subscribe to DeepL Pro to edit this document. Visit www.DeepL.com/profor more information. meetings where we discuss retrocomputing together; they will be able to lend a hand in the activities of recovery, restoration and maintenance of the equipment in the collection; they will represent the association in national retrocomputing events; they will be entitled to their own virtual space within the MICRO Museum website where they will have the opportunity to catalog and document their collection.

Fill out the application form below and we will consider your application in a very short time.

DONATE TO THE MUSEUM

ALL DONATIONS TO 8 BIT INSIDE ARE TAX-DEDUCTIBLE OR DEDUCTIBLE

BANK TRANSFER

IBAN IT95V0306909606100000146225

Made out to Cultural Association 8 Bit Inside - ONLUS

All donations to 8 Bit Inside are tax-deductible or deductible according to legal limits, provided they are made by bank transfer, check made out to 8 Bit Inside - Onlus with the "non-transferable" clause, credit cards. 8 Bit Inside is a nonprofit organization (nonprofit social organization) under Legislative Decree No. 460/97.

TAX ADVANTAGES FOR PEOPLE

Liberal donations in cash or in kind are deductible from gross tax for an amount equal to 30 percent of the liberal donations, for a total amount in each tax period not exceeding 30,000 euros. Alternatively, they are deductible from the total net income within the limit of 10% of the total declared income (Art.83 co.1 and 2 Decree No.117/2017).

TAX ADVANTAGES FOR ENTERPRISES

Liberal donations in cash or in kind are deductible from the total net income up to the limit of 10% of the total declared income. Any excess may be counted as an increase in the amount deductible from the total income of subsequent tax periods, but not beyond the fourth year, up to the amount of the excess (Art.83 co.2 Dlgs n.117/2017).